Irish Freedom Party President Hermann Kelly wrote to RTE recently highlighting a discrepancy in the figures they were reporting for Ireland’s contribution to the European Union’s coffers. Here is his letter and RTE’s response is below.

Dear Sir

In an article online entitled:

Government resisting EU ‘grab’ of corporate sector profits (Updated / Friday, 15 Sep 2023 20:00) by Tony Connolly (reference: 1)

It states in paragraph 7: “According to one calculation, if the mechanism were approved, Ireland’s annual contribution to the EU budget could increase by €1.5 billion from the current amount of €2.6 billion” and again under subhead “Alarm at idea” the article states: “Under the proposed formula of 0.5%, that would mean an extra €1.5 billion on top of Ireland’s existing gross national contribution, which stood at €2.6 billion in 2021.” The Department of Finance is quoted very extensively in the article.

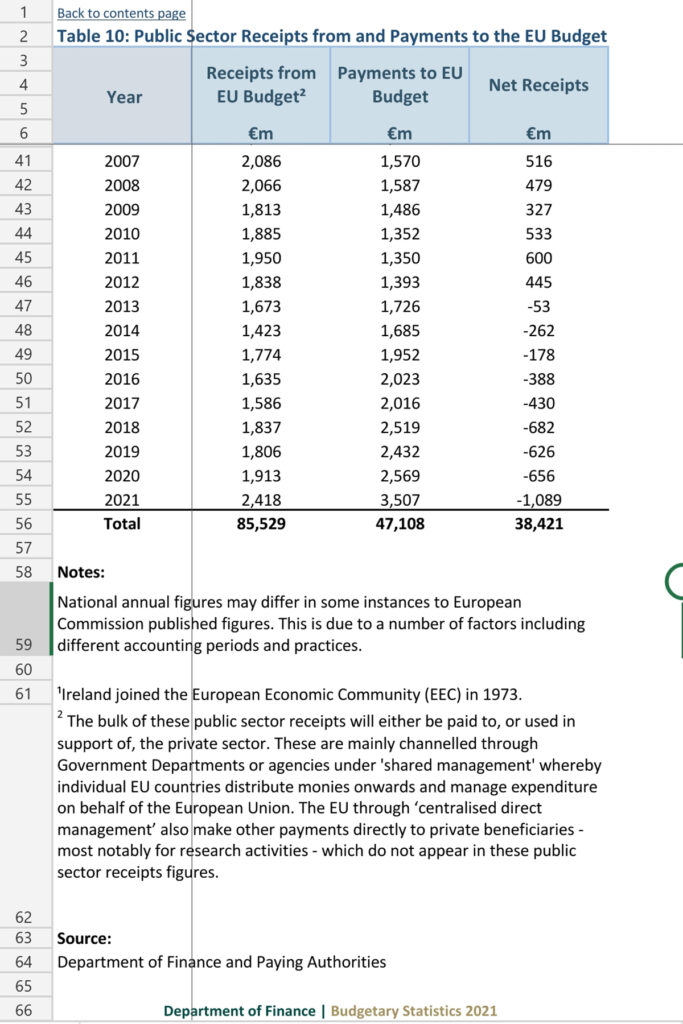

On the contrary, Ireland contributed 3.5 billion euro to EU budget in 2021, not €2.6 billion as per Tony Connolly article.

Indeed RTE has recently done an article based on official Government statistics, “Ireland has been a net contributor to the EU since 2013, according to the Comptroller and Auditor General’s report” (reference: 2).

In conclusion I state that article implying our national contribution to EU budget in 2021 was 2.6 billion euro is incorrect.

Therefore, I would ask that the Tony Connolly article above is updated to 3.5 billion euro as per official Department of Finance statistics.

Kind regards

Hermann Kelly

Irish Freedom Party

Reference 1

https://www.rte.ie/news/europe/2023/0915/1405522-eu-budget/

Reference 2

https://www.rte.ie/news/business/2023/0929/1408128-ireland-eu-budget-cag/

Reference 3

Dept. of Finance figures.

In response to Hermann Kelly’s letter, RTE have replied as follows:

Dear Mr Kelly,

I refer your email below

The position is as follows:

There are different ways of measuring a country’s contribution to the EU budget.

There is the contribution based on Gross National Income (GNI) and there are the contributions based on the VAT and Customs receipts that a member state collects on behalf of the EU.

According to an official at the European Court of Auditors, which issued its 2022 report this week, “The majority of [Ireland’s] contribution is a GNI based contribution (% of our GNI). In 2022, this amounted to €2.6 billion euro”]

That is, the contribution that does not include VAT and Customs receipts, which will bring the total up to roughly €3.5 billion.

Furthermore, contributions to the EU budget are offset by what a member state receives in EU funding.

Ireland received €2.4 billion in 2022. By referring to Ireland’s gross contribution, our Europe Editor was indicating it did not take account of what Ireland received in EU funding.

The fact he referenced Ireland’s GNI-based contribution was entirely deliberate and significant.

His report was about the fact that the European Commission has proposed that member states make an extra contribution based on the Gross Operating Surplus (GOS) of a member state’s corporate sector, i.e., the amount of corporate profit left over once salaries, production costs and other overheads are stripped out.

Ireland has the highest proportion of GOS to GNI in the European Union, which is central to the government’s concerns.

That is why the report mentions the figure of €2.6 billion: that is the GNI-based contribution to the EU budget, one which does not include VAT and Customs receipts.

Contrary to any notion that our Europe Editor, or RTE, is deliberately downplaying Ireland’s contribution, his online report on the Court of Auditors annual report this week is below and it includes Ireland’s contribution as per the GNI part and the VAT / Customs receipts part:

https://www.rte.ie/news/europe/2023/1005/1409110-eu-spending/

In that online report, he quoted the figures provided by the Court on Ireland’s contribution to the EU budget, this time for 2022.

“According to the ECA, Ireland contributed €3.4 billion in 2022, and received €2.4 billion, mostly from CAP payments, meaning a net contribution of around €1 billion.

“In 2021, Ireland paid in €3.4 billion and received €2.7 billion, meaning a net contribution of €0.7 billion.”

Again, on this occasion, the Court’s figures included VAT and Customs receipts meaning that they were the gross amount.

RTÉ stands over the report you refer to.

Yours Sincerely,

Brian Dowling