Fighting For Climate Realism

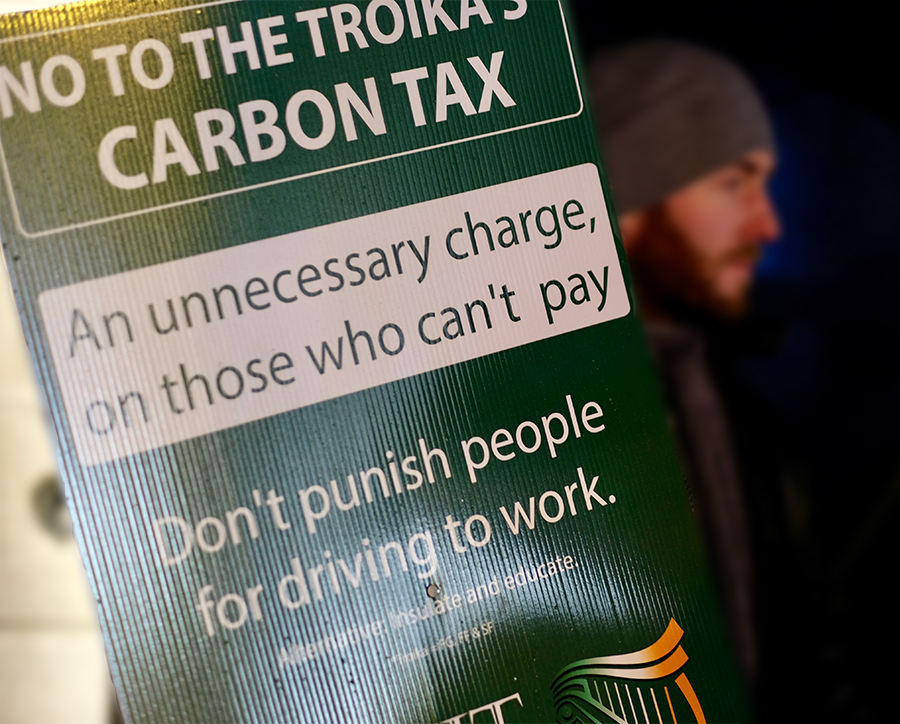

Why we say ‘No Way’ to the punishing Carbon Tax.

The carbon tax is a charge applied to carbon-based fuels such as coal, peat, oil and natural gas as well as farm products like meat and milk. Introduced in 2013, the tax is intended to reduce carbon dioxide emissions, and carbon dioxide as we know, is essential for photosynthesis and plant growth.

Climate change is real, it has demonstrably taken place for millennia and will continue to happen. But it is a silly idea to punish people for running their car, hitting industry with huge taxes and transferring this money through the emissions trading scheme (ETS) which hurts consumers and workers in European countries while funding our competitors in India and China which are heavy polluters. It’s bad economics and overall it doesn’t stop climate change.

The Irish Troika’s (FF, FG and SF) carbon tax will mean hefty increases in home heating bills and motoring costs. It will impact the average person driving to work. The elderly and the poor will be impacted the hardest. Most people need to drive to work and all people have to heat their home so it is a charge on an essential service.

According to Economic and Social Research Institute (ESRI) projections, the carbon tax will have to increase substantially – from €100 per person a year to €1,500 a year – if Ireland is to meet legally-binding targets on reducing greenhouse gas emissions by 2030. Or face EU fines of 600 million euro per year. The Irish Freedom Party hold that this is a cruel and unjust imposition on hard-pressed Irish families.

The Carbon tax has a number of disadvantages-

1. It imposes expensive administrative costs.

The carbon tax can be expensive to collect, considering that the government would need a substantial amount of money for its implementation.

2. It causes a shift in production.

It is highly possible that business establishments will move their operations to a region that has lower or no carbon tax. So, carbon tax would not stop carbon dioxide production, but would only change where and how it is produced.

3. It carries the risk of cost increases.

Many critics believe that this type of tax will increase fossil fuel costs, which will consequently increase expenditures that are involved in the production of basic goods and delivery of services.

4. It will affect homeowners, car owners, hauliers, farmers and the agri-food sector.

The carbon tax would also hammer the transport and haulage industry in Ireland and they could also struggle with fuel smuggling and fuelling elsewhere.

A recent report from the EAT-Lancet Commission suggested that meat consumption worldwide should be slashed by 90pc to tackle climate change. A carbon tax on meat production would have a hugely detrimental impact on the farming and Agri-food community in Ireland if it is allowed to take root.

An alternative is to put an emphasis on insulation and education and allow people to make the choices themselves. Are we opposed to increased pollution? Absolutely – CFCs, single-use plastics, heavy metals are all detrimental to the environment and need to be curbed but Carbon Dioxide is a naturally occurring gas in the atmosphere.

Ireland is surrounded by the sea so when the technology is sufficient, and economically within grasp, harnessing the renewable power of the sea and the tides could be advantageous to an island nation.